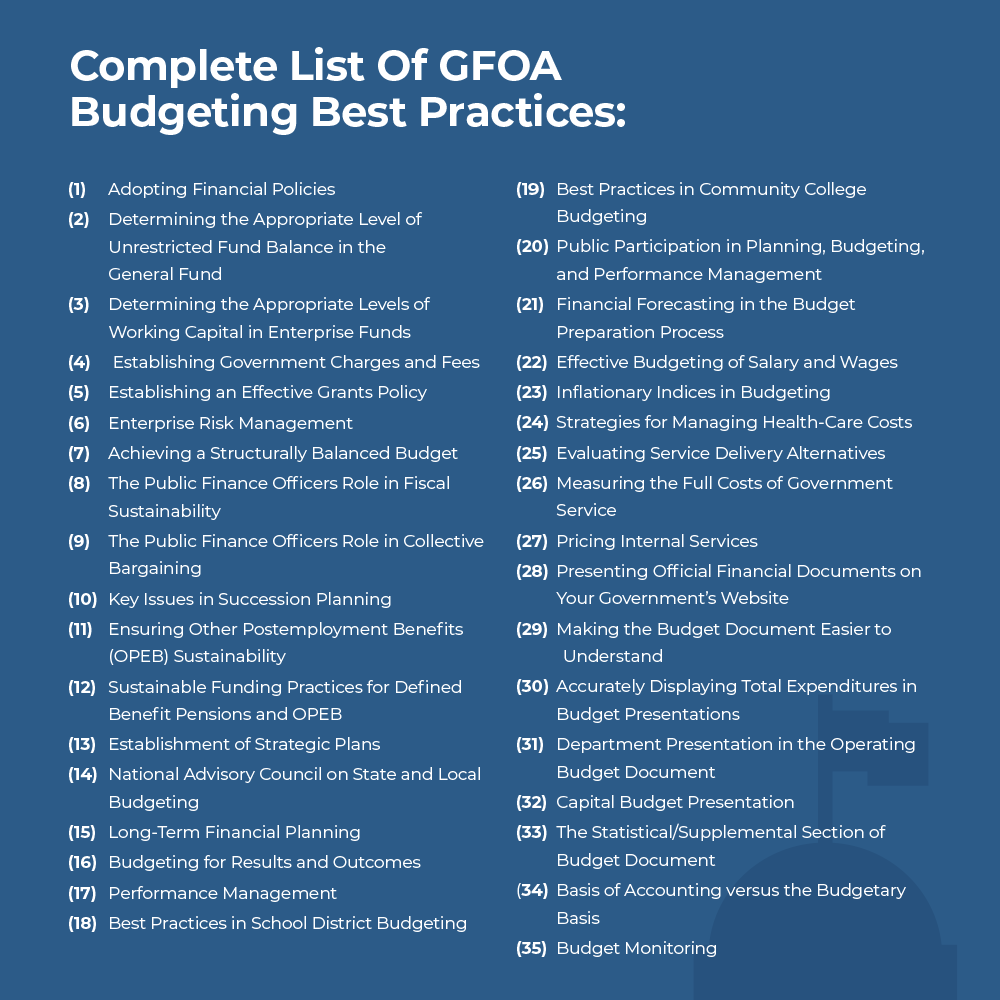

Top 10 GFOA Budgeting Best Practices The Government Finance Officers Association (GFOA) recently hosted a Budgeting Best Practices webinar where they reviewed 35 recommended budgeting strategies. Incorporating GFOA best practices into our budgeting software is a top priority for ClearGov, so we were excited to attend and learn. In case you missed it, here are what we consider to be the top 10 best practices shared in the webinar (plus the full list of 35 at the end) and how you can apply each of these to your local government’s budgeting process. #1 – Establishment of Strategic PlansStrategic planning is now a mandatory criterion for the GFOA Distinguished Budget Presentation Award, making it a priority for local governments wanting to submit their budget books for consideration. Governments should identify critical issues, problems, and needs as well as agree on a small number of broad goals. Then it’s recommended to create an action plan for tackling those goals and establish performance measures (also another mandatory criterion!) to monitor your progress. The GFOA recommends the following best practices as part of strategic planning. You can read the full guidelines here:

#2 – Long-Term Financial PlanningFor governments focused on transparency, long-term financial planning fosters civic engagement and trust. Citizens appreciate when they can see how their tax dollars are being used many years down the road. It’s recommended to show projections and assumptions (and explain their significance) as well as provide a narrative summarizing your findings and adding context to the numbers. The GFOA recommends the following best practices as part of long-term financial planning. You can read the full guidelines here.

#3 – Budgeting for Results and OutcomesBudgeting by Priorities (BP) and including a budgeting process overview helps citizens understand the overall process and precisely how their tax dollars are being spent to achieve results in the community. Instead of starting with the prior year’s budget, governments that use this strategy leverage a bottom-up approach to allocate funds and resources to the services and initiatives that are most important to citizens. The GFOA recommends the following best practices as part of budgeting for results and outcomes:

#4 – Performance ManagementPerformance management plays a key role in transparency. Local governments hold themselves accountable by allowing citizens to easily see if goals are being met – or not. The GFOA recommends that your performance measures directly relate to goals. This ensures that your decisions are more timely and accurate, and helps create a more dynamic and better policy making process. The GFOA recommends the following best practices as part of performance management. You can read the full guidelines here.

#5 – Effective Budgeting of Salary and WagesBecause salaries, wages, and benefits make up a large part of the overall budget, it’s important to have a very clear picture of your personnel budget. Forecasting strategies that result in more accurate personnel projections help local governments maintain tighter control over their budget. The GFOA recommends the following best practices as part of performance management. You can read the full guidelines here.

#6 – Presenting Official Financial Documents on Your Government’s WebsiteA key component of transparency is presenting your official financial documents front and center on your website – don’t hide them. Put them on your homepage or finance department page, and make sure they are easy to open, easy to view, and easy to understand. The GFOA recommends the following best practices as part of presenting official financial documents on your government’s website:

#7 – Accurately Displaying Total Expenditures in Budget PresentationsExpenditures tend to be overstated or double-counted. If you do double-count items, include a footnote to explain what is net versus growth. The GFOA recommends the following best practices as part of accurately displaying total expenditures in budget presentations. You can read the full guidelines here.

#8 – Department Presentation in the Operating Budget DocumentPaint a clear picture of each departments’ role within the government. Keep it brief, discuss the departments’ services, and include an org chart. As part of the strategic planning process, link performance measures to departmental goals or overall goals on individual department pages. The GFOA recommends the following best practices as part of the department presentation in the operating budget document. You can read the full guidelines here.

#9 – Capital Budget PresentationA long-term capital budget presentation helps citizens understand how their tax dollars are spent on large projects and major expenditures, and how the costs are allocated in coming years. Include a narrative about your process for evaluating, prioritizing, and deciding which initiatives are adopted. The GFOA recommends the following best practices as part of the capital budget presentation. You can read the full guidelines here.

#10 – Budget MonitoringFinally, if you’re not measuring it, you’re not managing it! It’s essential to have a process in place for comparing your budget to actual results. The GFOA recommends the following best practices for budget monitoring. You can read the full guidelines here.

Create Your Own Award-Winning Budget BookThe goal of these GFOA best practices is to help local governments prepare budget documents of the very highest quality. Governments that strive for greater transparency and civic engagement know that implementing these best practices into their budget books ultimately improves their relationship with their community. And hey, you could even win a shiny award for your wall! The GFOA Distinguished Budget Presentation Award Program exists to recognize excellence in government budgeting. To see a good example of best practices, check out the Digital Budget Book created by El Mirage, AZ that recently earned them the award. If you’ve never submitted your budget presentation for consideration, you can find all of the best practices and award criteria on the GFOA website. If you have submitted your budget for award consideration, be sure you’re aware of changes to the criteria that went into effect in 2021. You can find a recap of those changes in our GFOA Budget Awards Criteria: 2020 Revisions eBook.  |